Unlock Financial Success With Our Virtual Finance Director Service

At Vanilla Accounting, our virtual financial director (VFD) service is tailor-made for small and medium-sized enterprises (SMEs) who can’t afford a full-time in-house expert but need professional financial guidance that will drive business growth and success.

Why You Need A Handle On The Numbers

As a small business you face a challenging chicken-and-egg problem: how can you manage your finances to grow your enterprise when you don’t yet have the funds to employ a qualified financial director?

Starting a business is, for many people, a life ambition. You pour your savings, your energy, and every fibre of your being into your venture – yet, regrettably, two-thirds of start-up SMEs fail in the UK within the first 12 months, usually because their owners don’t have a secure understanding of their finances.

Knowing how your business is doing and how you can invest to strengthen its performance is crucial for long-term sustainability and success – which is where a virtual financial director can help.

What Is A Virtual Finance Director?

A virtual financial director is a specialist service offered by Vanilla Accounting through which SMEs can remotely access the expertise of a qualified and experienced financial director. Instead of hiring a full-time in-house expert who will eat into limited budgets, businesses can obtain the same level of financial proficiency and guidance on a part-time, project-based, or ongoing basis.

Although the term ‘virtual’ creates connotations of cutting-edge experimental technology, our VFD service is very much people-centric. By choosing Vanilla Accounting to provide your virtual financial director service, you’ll be working directly with our team of highly experienced and approachable chartered accountants, who cherish the opportunity to get to know you and your business.

Our VFD Services Include:

Financial Reporting

Financial Analysis

Cashflow Management

Financial Insights

Forecasting

What Are The Benefits Of A Virtual Finance Director?

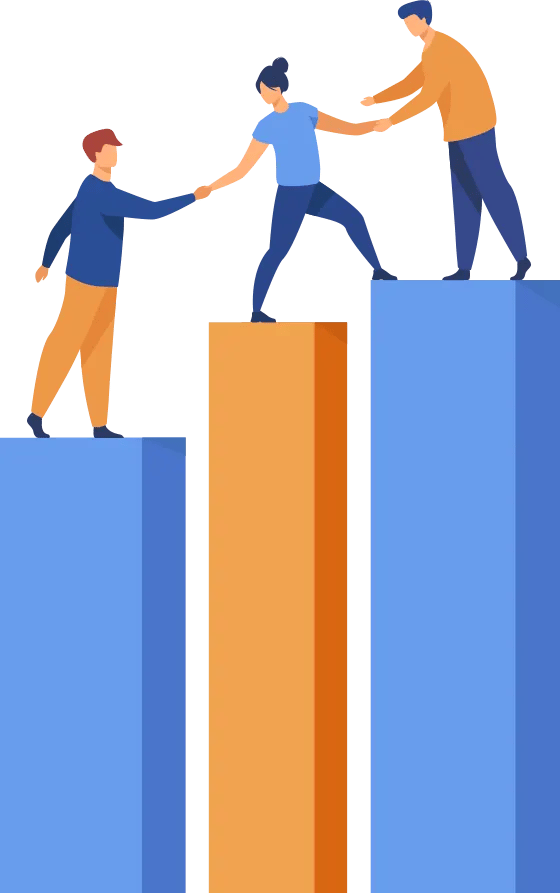

Cost Effectiveness

Hiring a full-time financial director can be expensive, especially for SMEs with limited funds. A VFD service allows small businesses to access high-quality financial expertise at an affordable rate, paying only for the services they use.

Flexibility

A virtual financial director offer flexible arrangements to enable businesses to tailor the service to their specific needs. Whether it's on a part-time basis, during peak financial periods, or for short-term projects, the flexibility ensures SMEs get the right support when they most need it.

A Jargon-Free Approach

In-house financial management can be complex and confusing, especially for SME owners who have limited experience or knowledge of the area. A virtual financial director will explain everything in easy-to-understand terms, free from bewildering jargon, to maximise your understanding of your business’s finances.

Extensive Experience

VFD services are offered by seasoned professionals with backgrounds in finance and accounting, with specialisms in budgeting, forecasting, or tax management. Their broad expertise allows them to quickly understand a business’s financial situation, identify areas for improvement, and provide strategic advice to drive growth.

Remote Collaboration

The virtual element of a VFD service enables seamless communication and collaboration. With the aid of technology, businesses can easily interact with their financial director, share financial data in real time, and benefit from timely insights that improve their decision-making.

Objectivity And Impartiality

The virtual element of a VFD service enables seamless communication and collaboration. With the aid of technology, businesses can easily interact with their financial director, share financial data in real time, and benefit from timely insights that improve their decision-making.

More Time To Focus On What Counts

By outsourcing financial leadership to a VFD, SME owners can focus on their core competencies without worrying about managing complex financial matters in-house.

Enhanced Financial Management

VFDs can implement robust financial controls, optimise cashflow management, and improve risk assessments to contribute to improved financial performance and stability.

Kind Words from our Clients

Their thoughts define us

Clients come to us because they have heard some good things about us. We are therefore very thankful to those who have said the following kind words. We keep them in front of our desks and also in our minds not because we are proud of it but because it serves as a reminder of the expectations we have to meet.

patience

David Goddard,

Tundra Property

Development

Limited

We appreciate Vanilla Accounting for their clarity and patience. They are professional in what they do but they don’t make us feel too bad when deadlines are approaching.

responded

quickly

Paul King,

April King

Vanilla Accounting provided a professional service and always responded quickly to any request I may have and I have no hesitation in recommending them.

Tom Gormanly MyDigisafe Limited

We have worked with Phil for over 10 years. More recently he has helped us set up and provide bookkeeping and accounting services to our new businesses and he undertook a finance director ole with our previous businesses which added a lot of value.

Anthony Epworth, Anthony Epworth Limited

I am very pleased with the service I receive and I am confident that using Vanilla Accounting saves me money.

Andy Davis, Neonavitas Limited

Vanilla Accounting’s service has been very good and just what we needed. Vanilla Accounting have been dealing with all our bookkeeping on Xero and the service has been very good and we have no complaints.

Mark Warner, Page one Pictures

I have worked with Phil and Vanilla Accounting now for over a number of years. They are flexible and work around me and my requirements as a business owner and we meet as necessary to discuss the accounts and tax position of the business and that of myself personally.

Paul Bibby, Optillion Limited

Having Phil Edwards as our accountant undoubtedly adds value to our business. He is a proactive accountant acutely aware of his clients financial well-being.

Frequently Asked Questions

How will you ensure effective communication with me?

At Vanilla Accounting, regular communication is a key aspect of our service to ensure you’re kept in the loop regarding your business’s financial performance. After your initial free in-person consultation with our team, we’ll meet often with you via video and phone calls so that you never feel isolated or left behind. Through close collaboration, we’ll guide you on your business journey, discussing essential metrics, non-financial KPIs, and previously overlooked monitorable elements that are significant for your business's success.

We need to install new accounting software. Is this the right time for a VFD?

Absolutely! An expert virtual financial director can oversee the process of change within your business and help to make it smoother and less nerve-tingling. Transitioning to cloud accounting or implementing new accounts software will benefit from having a VFD who understands your business’s finances and goals.

How often should management accounts be produced?

Typically, management accounts are prepared monthly or quarterly, which supports your business to plan its capital expenditure, optimise its profits, and make the most of the available capital allowances.

How can management accounts benefit my business in practice?

Management accounting offers considerable benefits for businesses. For example, a growing business that is struggling to manage its costs and profit margins then regular management accounts are essential to know where you are. This will enable it to identify cost-saving measures, renegotiate contracts, and quickly spot unprofitable ventures so that owners can identify and seize more lucrative opportunities instead.

What are your management accounting charges?

At Vanilla Accounting, we operate a simple, easy-to-understand fee structure to give our clients clarity about how much our management accounting services will cost. We’ll be happy to discuss this with you when you arrange your free, no-obligation initial consultation with our expert chartered accountants.

Book A Free Consultation With Our Team

To find out more about Virtual Finance Director and the benefits for your small business, please get in touch to arrange a free, no-obligation consultation.

Did You Know

A 10% increase in your key numbers

produces a 33% increase in profit?

Get a Free Gap Analysis