Tailored Tax Advice And Solutions For Ambitious Business Owners And Individuals

At Vanilla Accounting, our expert team of tax advisors and qualified chartered accountants provides a comprehensive portfolio of corporate and personal tax services for businesses and individuals.

By taking the time to understand your financial position, we design tailored solutions to your tax issues and lead you through the complex web of compliance requirements to meet HMRC regulations. As well as ensuring you meet your obligations on time and in full, we apply different strategies and innovative approaches to reduce your tax liability and optimise your use of tax breaks and ‘use them or lose them’ allowances.

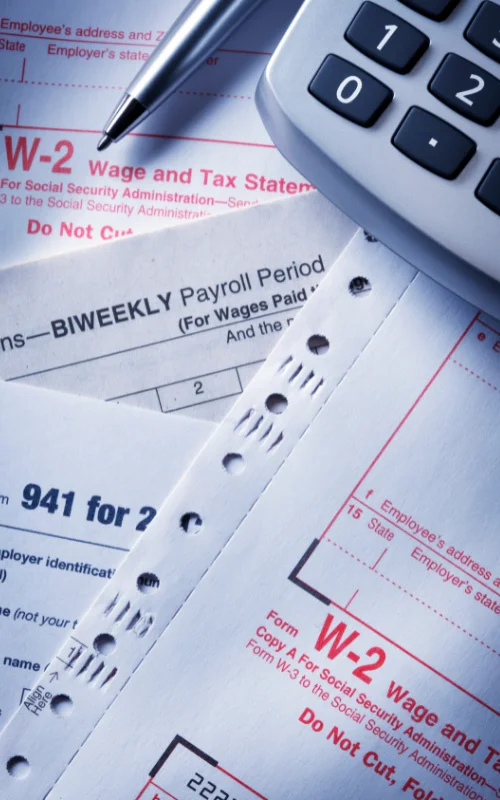

Our Tax Services

At Vanilla Accounting, we provide specialist tax services in all areas of taxation, including:

Company corporation tax returns

Manage personal tax returns

VAT accounting returns

P11D forms completion

Reporting and compliance

We take pride in our clear and concise communication that won’t leave you confused by unintelligible jargon. Our services range from tax consulting to outsourced tax compliance to help you to grow your business and ensure you meet your legal obligations.

Why Choose Vanilla Accounting?

At Vanilla Accounting, we understand that, for many people and businesses, managing their tax affairs is complicated and time-consuming. With regulations frequently changing, it’s difficult to know whether you’re making the most of the available tax breaks and allowances, and you may be worried that you’re not meeting your liabilities on time.

By choosing Vanilla Accounting as your tax advisory partner, you will benefit from:

Access to the latest corporation tax software – Why invest money in purchasing it when we already have it?

More time to focus on growing your business – With our expert team managing every aspect of your tax affairs on your behalf, you won’t need to spend a single minute ploughing through complex figures and documents.

Compliance with evolving laws – When you’re trying to run a business, it’s hard to keep up with the changing face of tax legislation, so our knowledgeable team of experts will ensure you’re compliant at all times.

Only paying what you need to – We’ll make sure that your accounts are filed accurately and on time, and that you’ll only pay what you’re obliged to. With no more worries about missing deadlines and incurring HMRC penalties, you’ll be able to focus on more important things in life.

More astute use of your income – By taking advantage of the available tax breaks and allowances, you’ll have more money in your bank account to spend on business investments or those little luxuries that make life that much better.

It’s Time to Review Your Tax Affairs.

At Vanilla Accounting, we offer a free review of your tax affairs so you can understand whether you’re optimising your income and meeting your legal obligations correctly.

To arrange your free, no-obligation consultation with one of our tax experts, please get in touch today.

Frequently Asked Questions

How much do your tax services cost?

At Vanilla Accounting, we operate a simple pricing structure that is tailored to your needs, with no unexpected surprises that you can’t afford. We recognise that you need certainty to plan your spending, so we’ll be upfront from the start about how much our tax services will cost, and you’ll only pay for what you use.

Isn’t it cheaper to manage my own tax affairs?

We passionately believe that outsourcing your tax affairs is a cost-effective decision. Managing your own tax may seem a cheap option, but you’ll be able to spend less time focusing on expanding your business and may miss out on lucrative growth opportunities. And, if you get your calculations wrong, the financial penalties can be staggering.

What are your aims when providing tax advice?

At Vanilla Accounting, our tax services are unpinned by three core aims:

To help you to make more profit.

To ensure you don’t pay a penny more in tax than is necessary.

To help you to invest your time more wisely to achieve greater profitability.

I would like you to manage my tax for me – but where do I start?

The first step to outsourcing your tax affairs to Vanilla Accounting is to arrange an initial review with one of our expert advisors. At this meeting, we’ll find out more about your situation and your existing liabilities, and whether you’re taking full advantage of the available tax breaks. This initial review is entirely free with no obligation.

Kind Words from our Clients

Their thoughts define us

Clients come to us because they have heard some good things about us. We are therefore very thankful to those who have said the following kind words. We keep them in front of our desks and also in our minds not because we are proud of it but because it serves as a reminder of the expectations we have to meet.

patience

David Goddard,

Tundra Property

Development

Limited

We appreciate Vanilla Accounting for their clarity and patience. They are professional in what they do but they don’t make us feel too bad when deadlines are approaching.

invaluable

Simon Doyle

You have been an invaluable, crucial and above all great group to work with through our journey – a lot would not have been possible without your excellent support throughout.

responded

quickly

Paul King,

April King

Vanilla Accounting provided a professional service and always responded quickly to any request I may have and I have no hesitation in recommending them.

Tom Gormanly MyDigisafe Limited

We have worked with Phil for over 10 years. More recently he has helped us set up and provide bookkeeping and accounting services to our new businesses and he undertook a finance director ole with our previous businesses which added a lot of value.

Anthony Epworth, Anthony Epworth Limited

I am very pleased with the service I receive and I am confident that using Vanilla Accounting saves me money.

Andy Davis, Neonavitas Limited

Vanilla Accounting’s service has been very good and just what we needed. Vanilla Accounting have been dealing with all our bookkeeping on Xero and the service has been very good and we have no complaints.

Mark Warner, Page one Pictures

I have worked with Phil and Vanilla Accounting now for over a number of years. They are flexible and work around me and my requirements as a business owner and we meet as necessary to discuss the accounts and tax position of the business and that of myself personally.

Paul Bibby, Optillion Limited

Having Phil Edwards as our accountant undoubtedly adds value to our business. He is a proactive accountant acutely aware of his clients financial well-being.

team

Simon Doyle

You’ve really felt like part of our team since day 1 and we are all incredibly grateful for that, so thank you so much and wish you/Vanilla continued success in the future.

Did You Know

A 10% increase in your key numbers

produces a 33% increase in profit?

7 key Numbers To Help Your Business Succeed

Are you ready to take your business to the next level? Do you want to identify areas where your organisation can improve and grow? Fill in the form below to download our leaflet 'The 7 Key Numbers Within Your Business To Help You Succeed', which also features a demonstration of the analysis we do aiming at business profitability.